Category:Fossil Fuels

'Vertical slab in front of the Statoil building, imprinted with an image of an Easter Island’s moai — a haunting stone, pinnacle of a great, but vanished, Rapa Nui civilization'

The headquarters of Statoil, outside Oslo. Credit Andrew C. Revkin

··········

2024

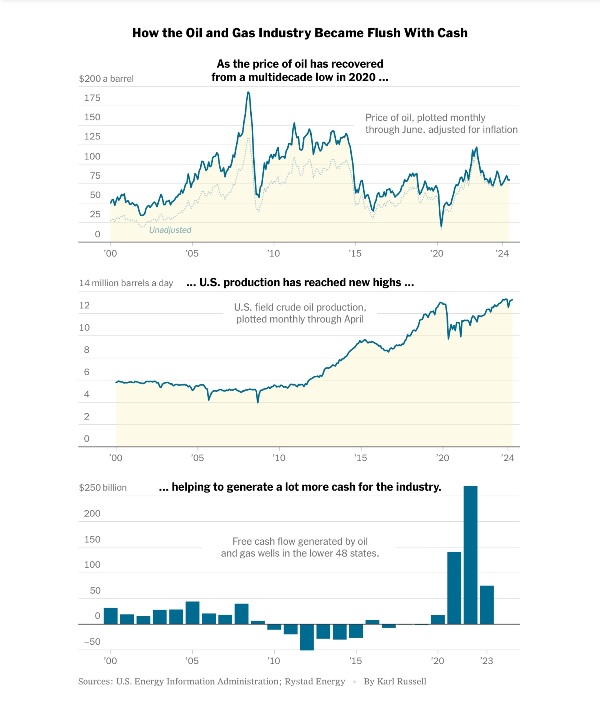

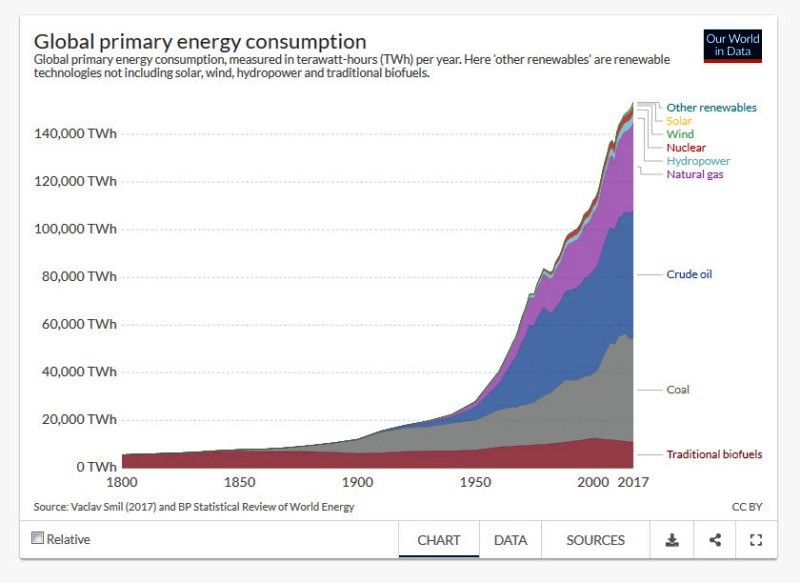

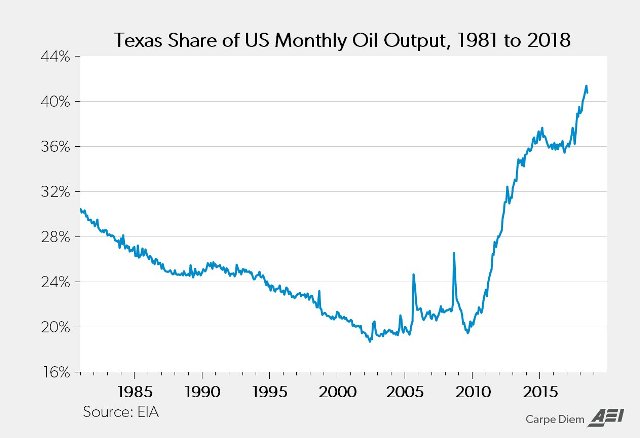

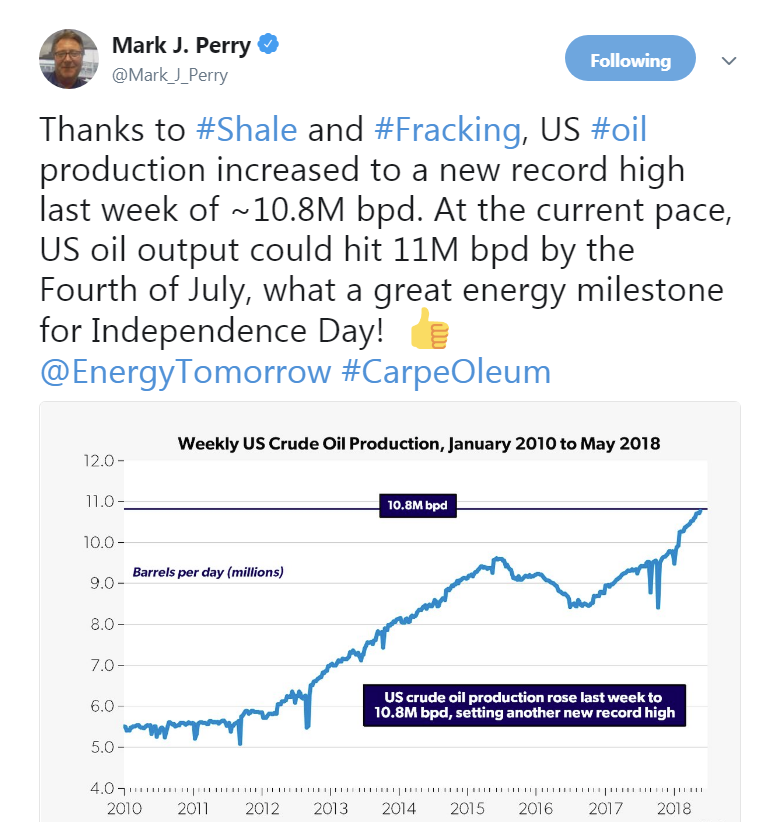

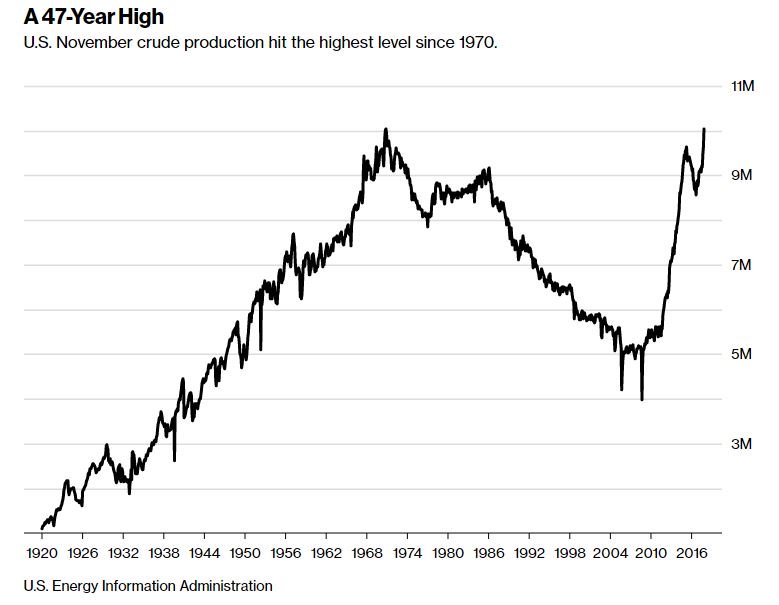

For all of the focus on an energy transition, the American oil industry is booming, extracting more crude than ever from the shale rock that runs beneath the ground in West Texas.

After years of losing money on horizontal drilling and hydraulic fracturing, the companies that have helped the United States become the leading global oil producer have turned a financial corner and are generating robust profits. The stocks of some oil and gas companies, such as Exxon Mobil and Diamondback Energy, are at or near record levels.

2023

November

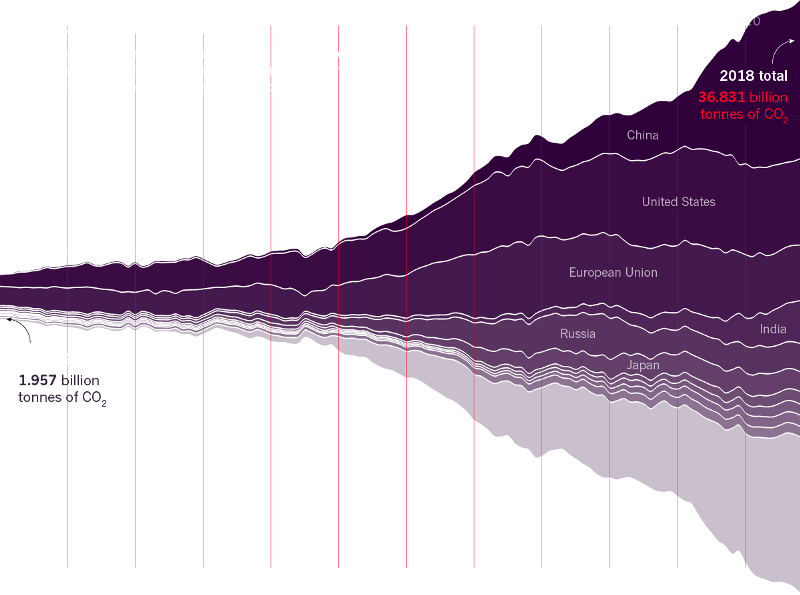

US oil fields are gushing again, helping to drive down fuel prices but also threatening to undercut efforts to reduce greenhouse gas emissions.

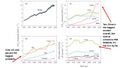

Only three years after U.S. oil production collapsed during the pandemic, energy companies are cranking out a record 13.2 million barrels a day, more than Russia or Saudi Arabia. The flow of oil has grown by roughly 800,000 barrels a day since early 2022, and analysts expect the industry to add another 500,000 barrels a day next year.

- https://www.nytimes.com/2023/12/01/business/energy-environment/us-oil-production-record-climate.html

····················

October

U.S. oil production hits all-time high, conflicting with efforts to curb climate change

Via PBS

OPEC says oil demand will hit 110 million barrels per day in 2045

- “We see global energy demand increasing by 23% through 2045,” said the oil cartel’s secretary general.

····················

CERAWeek

Oil/Gas Biggest Annual Conference

·································································

Profit-taking in a Profitable Year

- Saudi oil giant Aramco posts record $161.1 billion profit for 2022

- Four oil companies had total sales of $1 trillion last year

- Chevron, ConocoPhillips, Exxon and Shell all reported record profits in 2022

Oil giant Saudi Aramco has reported earning $161bn last year, claiming the highest-ever recorded annual profit by a publicly listed company and drawing immediate criticism from activists.

- The monster profit by the firm, known formally as the Saudi Arabian Oil Co., came off the back of energy prices rising after Russia launched its war on Ukraine in February 2022, with sanctions limiting the sale of Moscow’s oil and natural gas in Western markets.

Exxon, Shell, BP, Chevron....

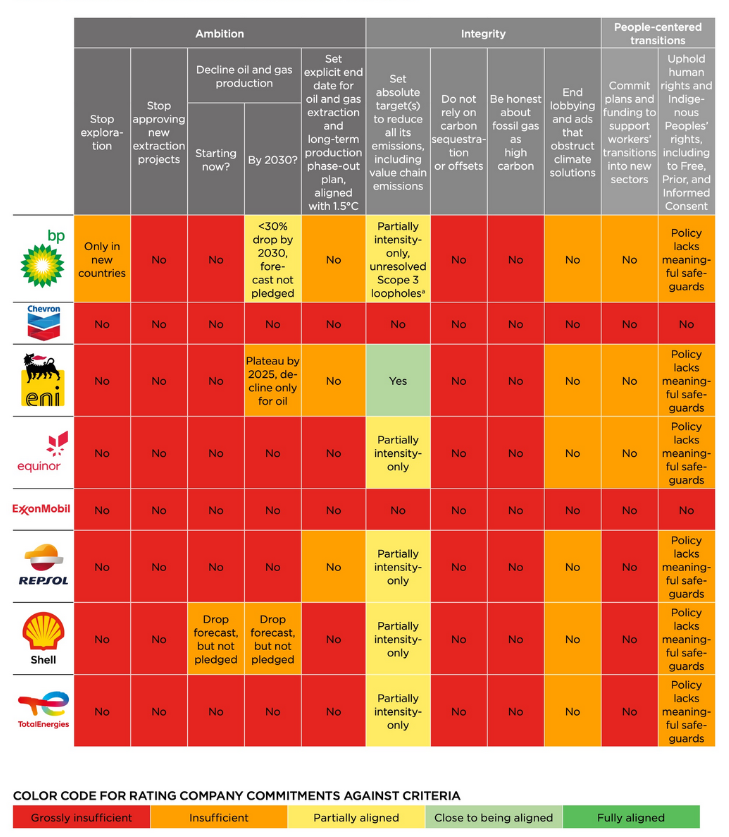

BP dials back climate pledge amid soaring oil profits

BP is scaling back its climate goals and deepening its investments in oil and gas, casting new doubts on big oil companies’ promises to embrace clean energy.

The British energy giant had aggressively embraced the energy transition, adopting a green starburst logo and the slogan “Beyond Petroleum.” But on Tuesday, the company announced less ambitious targets for cutting oil production as it reported making more money than ever in 2022.

In its quarterly earnings report, the company said it made $27.7 billion last year, more than double its 2021 profits. It was the latest in a string of reported windfalls in the industry that are drawing rebuke all the way up to the Oval Office. Shell posted a $41.6 billion profit for last year, more than $10 billion higher than its previous record. ExxonMobil and Chevron both announced their highest profits ever, too, with $55.7 billion and $36.5 billion, respectively.

Chevron Reports Record-Breaking Profits For 2022

Chevron (NYSE: CVX)... highest annual profit ever...

Chevron earnings for last year more than doubles from 2021 to $36.5 billion... record U.S. production.

- Plans (Substantive or Not?) for investing in 'Green and Clean' energy...

2022

Today (July 30), oil giants ExxonMobil and Chevron reported historic profits from the last three months. Exxon made $17.9 billion (not a typo) last quarter, up 273% from the same time last year, while Chevron made $11.6 billion. Exxon’s rate of income was $2,245.62 every second of every day for the past 92 days; Chevron made $1,462.11 per second.

Together, BP, Chevron, ExxonMobil, Shell, and TotalEnergies are expected to announce $60 billion in profits for the past three months. They plan to spend much of the profit not on reinvesting in their businesses, but on stock buybacks, which drives up the price of the stock. (HCR)

○

Did You Know BTW?

Natural gas is composed of 70-90% methane, a potent greenhouse gas and major contributor to global warming. The American public perceives “natural gas” much more favorably (76% favorable) than other fossil fuels like oil (51% ) or coal (39%). They also believe natural gas is much less harmful to human health than is coal or oil.

How much does natural gas benefit from its name, which includes the word “natural”? To answer this question, we conducted an experiment to investigate the public’s emotions and associations regarding the terms “natural gas” and “methane.” We randomly assigned respondents to one of four conditions in which each respondent was asked to rate their positive and negative feelings (affect) about one of the following four terms: “natural gas,” “natural methane gas,” “methane,” or “methane gas.”

We found that the term “natural gas” evokes much more positive feelings than do any of the three methane terms. Conversely, the terms “methane” and “methane gas” evoke much more negative feelings than does “natural gas.”

The hybrid term “natural methane gas” is in the middle — it is perceived more positively than “methane” or “methane gas,” but more negatively than “natural gas.” That is, the addition of the word natural substantially increases respondents’ positive feelings about methane, indicating that the positive feelings generated by the word “natural” partially compensate for the negative feelings generated by the word “methane.”

Should it be called “natural gas” or “methane”?

2022

CNBC Interview: Exxon CEO says no new gas cars globally by 2040

Via Electrek -- CNBC

June 26, 2022

- https://www.cnbc.com/2022/06/25/exxon-mobil-ceo-all-new-passenger-cars-will-be-electric-by-2040.html

Every new passenger car sold in the world will be electric by 2040, according to Exxon Mobil CEO Darren Woods, in an interview aired this weekend by CNBC.

The interview also covered the company’s climate ambitions, putting a flashy coat of paint on an organization that is the world’s 5th largest historical polluter and has pushed climate denial at a high level for half a century.

Exxon Mobil CEO Darren Woods sat down with CNBC’s David Faber for a long interview about climate change. The full interview is 35 minutes long (on top of a previous hour-long interview) and mostly discusses climate change and Exxon’s carbon capture and storage desires....

~

The oil giant is predicting that by 2040, every new passenger car sold in the world will be electric, CEO Darren Woods told CNBC’s David Faber in an interview. In 2021, just 9% of all passenger car sales were electric vehicles, including plug-in hybrids, according to market research company Canalys. That number is up 109% from 2020 says Canalys.

In light of its modeling, Woods said Exxon Mobil is evaluating how the decline in gasoline sales could impact its business. Exxon Mobil is one of the largest publicly traded international gas companies and a leader in the industry. Its website boasts that it is the largest “refiner and marketer of petroleum products,” as well as a chemicals company.

Woods, who spent a part of his career on the chemical side of the company’s operations, says chemicals will be key to keeping the company profitable during the clean energy transition. The plastics that Exxon Mobil produces can be used in the manufacturing of electric vehicles.

ExxonMobil’s calculations predicted that oil demand in 2040 would be equivalent to what the world needed in 2013 or 2014. Woods explained to CNBC that the company was still profitable at that time.

Woods seemed unfazed by the prediction, saying “that change will not make or break this business or this industry quite frankly.”

May 2022

Oil Price Continues to Surge

April 2022

March 2022

··························································

Big Oil/Gas Companies: Profits Up

Russia-Ukraine War Brings Disruptions and Sanctions: Oil/Gas/Fuel Prices Surge in 2022

(2021 Report) The largest oil and gas companies made a combined $174bn in profits in the first nine months of the year as gasoline prices climbed in the US, according to a new report.

The bumper profit totals, provided exclusively to the Guardian, show that in the third quarter of 2021 alone, 24 top oil and gas companies made more than $74bn in net income. From January to September, the net income of the group, which includes Exxon, Chevron, Shell and BP, was $174bn.

- https://www.theguardian.com/business/2021/dec/06/oil-companies-profits-exxon-chevron-shell-exclusive

December 2021

23rd World Petroleum Congress opens in Houston

October 2021

- Climate News

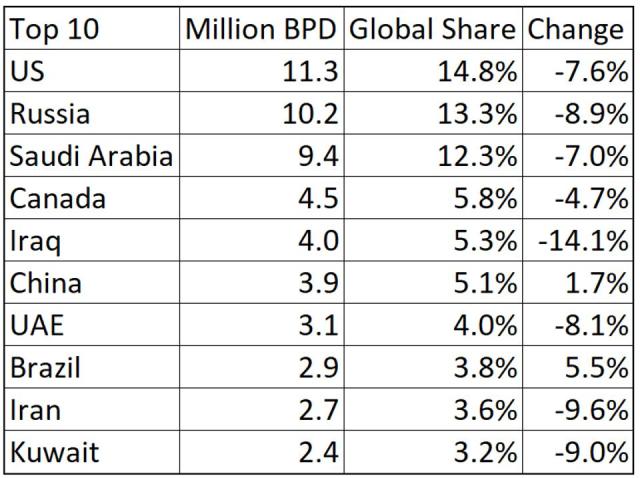

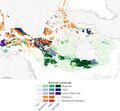

- Oil Production 2020 / National Top Producers / Barrels per Day / Change Year on Year

May 2021

March 2021

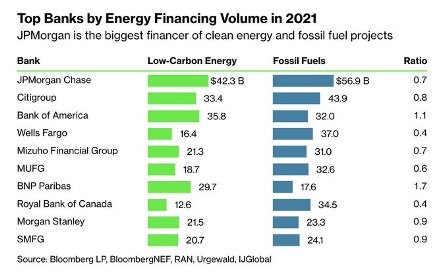

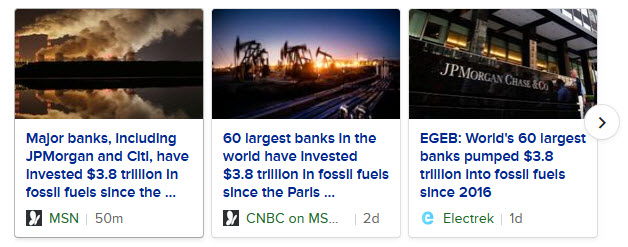

"Banking on Climate Chaos" (PDF)"

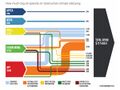

Introduction: This report analyzes fossil fuel financing from the world’s 60 largest commercial and investment banks — aggregating their leading roles in lending and underwriting of debt and equity issuances — and finds that these banks poured a total of $3.8 trillion into fossil fuels from 2016–2020.

- 1. Fossil fuel financing dropped 9% last year, parallel to the global drop in fossil fuel demand and production due to the COVID-19 pandemic.

- 2. And yet 2020 levels remained higher than in 2016, the year immediately following the adoption of the Paris Agreement.

60 largest banks in the world invested $3.8 trillion in fossil fuels: Report

"Despite the economic recession induced by the coronavirus pandemic, more money went into the industry in 2020 than in 2016"

The world’s 60 biggest banks have financed the fossil fuel industry to the tune of nearly $4 trillion in the five years since the Paris climate agreement, according to a report released March 24th by a coalition of environmental organizations.

The report was authored by Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil Change International, Reclaim Finance, and Sierra Club, and is endorsed by over 300 organizations from 50 countries around the world.

January 2021

October 2020

Conoco Buys Concho

Doubling down on the Permian Basin

Both companies have lost more than 40% of their value in 2020

Conoco is focusing on the West Texas/South New Mexico Permian Basin, the shale and fracking hotbed that made the United States the world's largest oil producer. Concho is viewed as one of the best Permian operators and brings along a large amount of expertise on the region.

The move will also make Conoco even more exposed to the same forces that have swiftly moved against fossil fuels.

"It is a bit of a contrarian move to double down on oil and gas at a time when it's unpopular in the investment community," said Pavel Molchanov, energy analyst at Raymond James Financial in Clearwater, Florida. "Many investors are turned off by the commodity volatility, regardless of what they think about climate," said Molchanov.

Europe is moving the opposite direction

The broader challenge to the deal is the climate crisis.

The mood is so glum in the oil industry that European oil majors are pivoting away from oil and gas in favor of renewables and low-carbon solutions.

BP revealed plans in August to slash its oil production by 40% and pour billions of dollars into clean energy as it attempts to deliver net-zero emission by 2050. The UK company also warned that world demand for oil may have peaked last year.

ExxonMobil, once the world's most valuable company, was recently surpassed in market capitalization by wind and solar company NextEra Energy.

August 2020

Exxon Mobil replaced by software stock after 92 years in Dow is 'sign of the times'

Exxon Mobil's been in the Dow in some form since 1928, but its tenure as the longest-serving component is coming to an end.

S&P Dow Jones Indices announced the largest changes to the 30-stock benchmark in seven years.

Exxon will be replaced by Salesforce. Amgen and Honeywell International are replacing Pfizer and Raytheon Technologies.

·····························

May / April 2020

Collapse

Down, Down, Down

Bank/Lender Takeovers Shock the Shale/Oil Patch

U.S. Shale Bust Like No Other

Oil Price Spiral Puts Fracking Industry in the Crosshairs

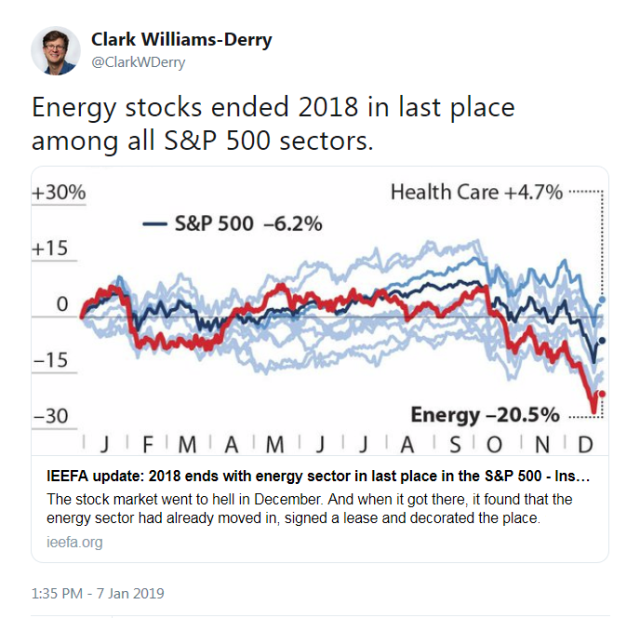

“It’s a financial bloodbath,” said Clark Williams-Derry, an analyst at the Institute for Energy Economics and Financial Analysis. “With oil prices at the current level, there’s a real risk many of them will simply go bankrupt.”

Fracking now makes up 63% of U.S. oil production, the Energy Information Administration estimates. That figure was set to increase as oil/gas drilling grew faster in the U.S. than any other country, and 90% of that is dependent on fracking, according to a report by scientists at more than a dozen environmental groups.

··································

Ten million barrel cut and/or performance art?

Brett McGurk, Energy policy 'spasms'

Oil/Gas Stock Prices Continue to Plunge

Gasoline Demand Falls ... Covid Times

···················

March 2020

'Oil prices plunge to 17-year lows as demand drop threatens to overwhelm storage facilities

Crude oil prices tank as continued fears over the Covid / Coronavirus pandemic slam energy demand.

West Texas Intermediate (WTI) the US benchmark dropped below $20 a barrel in Asian trading while Brent crude hit $23.03, its lowest price since 2002.

The ongoing price war between producers Russia and Saudi Arabia alongside concerns over storage capacity has sunk prices.

·····················

February 2020

BP pledges to cut emissions, NetZero by 2050, as memories of the Deepwater Horizon Gulf of Mexico disaster continue

BP 'Reimagining Energy' ... Our purpose is reimagining energy for people and our planet. We want to help the world reach net zero and improve people’s lives.

- We will aim to dramatically reduce carbon in our operations and in our production, and grow new low carbon businesses, products and services.

- We will advocate for fundamental and rapid progress towards Paris and strive to be a leader in transparency.

- We know we don’t have all the answers and will listen and work with others.

- We want to be an energy company with purpose; one that is trusted by society, valued by shareholders and motivating for everyone who works at BP.

- We believe we have the experience and expertise, the relationships and the reach, the skill and the will, to do this.

This will mean tackling around 415 million tonnes of emissions – 55 million from our operations and 360 million tonnes from the carbon content of our upstream oil and gas production. Importantly these are absolute reductions, to net zero, which is what the world needs most of all. We are also aiming to cut the carbon intensity of the products we sell by 50% by 2050 or sooner.

The world’s carbon budget is finite and running out fast; we need a rapid transition to net zero. -- Bernard Looney, chief executive officer

○

·····················

January 2020

Famous Money Advisor - Author - TV Personality, Jim Cramer, is down on fossil fuel companies

I'm done with fossil fuels. They're done... We're in the death-knell phase.

- (Video interview)

Real Money's Jim Cramer explains...

ExxonMobil Down Again

(CNN Business) ExxonMobil used to have bragging rights as the world's most valuable public company. Now, America's largest oil company is in steady decline... $184 billion has been wiped off Exxon's market valuation since its 2014 peak...

Exxon's (XOM) stock plunged to nine-year lows Tuesday after posting dreadful results that suggest a turnaround is unlikely any time soon.

○

(CNN) At the World Economic Forum in Davos, Switzerland

U.S. president touts US oil/gas production -- and dismisses concerns about CO2 greenhouse gas emissions

President Donald Trump attacked climate activists as "perennial prophets of doom" on Tuesday while addressing the World Economic Forum in Davos, Switzerland, where the agenda is focused on tackling the climate crisis.

○

Trump's remarks underscored the chasm between his denialist view of climate change and the overwhelming scientific consensus driving the rest of the developed world to action. Speaking shortly after the teenage climate activist Greta Thunberg accused world leaders of not taking action, Trump rejected calls for urgent action and encouraged the world to instead embrace "optimism."

"To embrace the possibilities of tomorrow, we must reject the perennial prophets of doom and their predictions of the apocalypse," Trump said.

○

Royal Dutch Shell Capital Investments on New Production Set to Rise

- Time to add in 'Environmental Full-Cost Accounting'

○

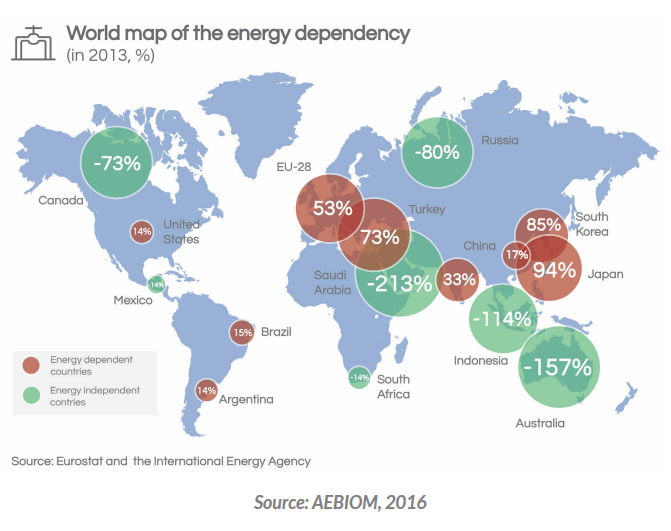

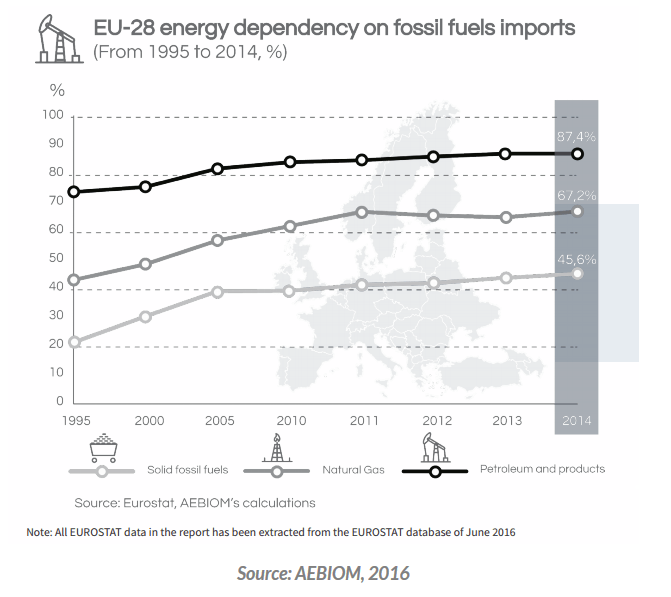

US Gas-Oil Production Dominates

When it comes to these new oil and gas fields, production from the US is set to eclipse the rest of the world.

○

Norway’s $1tn wealth fund set to cut oil and gas stocks

• https://www.ft.com/content/d32142a8-418f-11e9-b896-fe36ec32aece

Norway’s $1tn sovereign wealth fund is set to sell out of a host of oil and gas companies but stop short of abandoning the biggest energy majors such as BP and ExxonMobil as it prepares for one of the largest divestments of fossil fuel assets.

The Norwegian oil fund, which is the world’s largest sovereign investor, would dispose of about $7.5bn of oil and gas companies that are focused purely on exploration and production under the proposal from the centre-right government in Oslo.

The move is designed to reduce the dependence of Norway — western Europe’s biggest petroleum producer — on an industry that is facing growing questions about its long-term future. Global oil demand is forecast by many experts to peak by the 2030s while climate targets are speeding up efforts to reduce dependence on fossil fuels.

Financial Times: "Shockwaves through the energy sector"

EIA Interactive Chart (Beta) / Crude Oil Proved Reserves

• https://en.wikipedia.org/wiki/List_of_countries_by_proven_oil_reserves

• https://www.worldatlas.com/articles/the-world-s-largest-oil-reserves-by-country.html

○

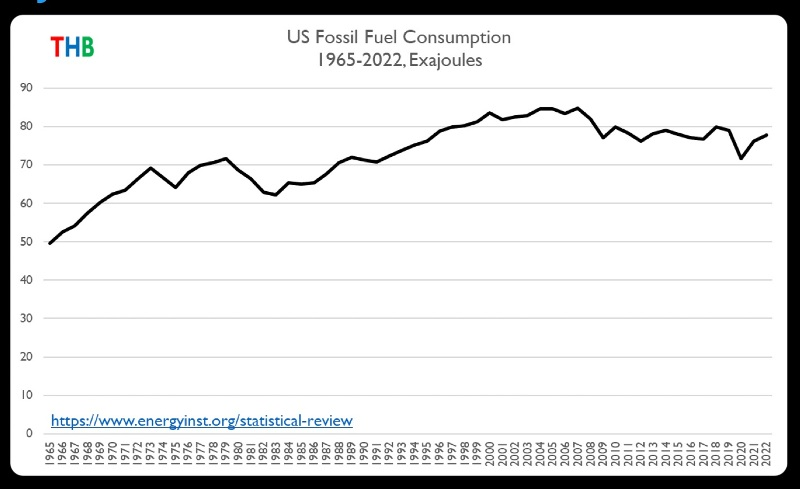

Energy Priorities, Geo-politics & Fracking in the U.S.

Production Up, Priorities Go to Fossil Fuels

- New Fracking Production Technology Changes Near-term Projections

- Costs of Environmental Impacts Put Off by the Trump Administration

·····························

Let's Talk Coal

·····················································································

Elon Musk Talks Need for Alternatives to Fossil Fuels

"The greater the change to the chemical composition of the physical, chemical makeup of the oceans and atmosphere [due to increased carbon emissions], the greater the long-term effect will be... [W]hy would you run this crazy experiment to see how bad it'll be? We know it's at least some bad, and the overwhelming scientific consensus is that it'll be really bad."

“Even if you put the environmental consequences of dramatically changing the chemical composition of the oceans and atmosphere aside, we will eventually run out of oil...

"If we don’t find a solution to burning oil for transport, and we then run out of oil, the economy will collapse and civilization will come to an end as we know it. And so if we know that we have to ultimately get off oil no matter what — we know that is an inescapable outcome, it’s simply a question of when, not if...

"Then, why would you run this crazy experiment of changing the chemical composition of the atmosphere and oceans by adding enormous amounts of CO2 that’ve been buried since the pre-Cambrian era? That’s crazy. That is the dumbest experiment in history, by far. Can you think of a dumber experiment? I honestly cannot. What good could possibly come of it?”

····································

Fossil Fuel Bubbles

• https://iopscience.iop.org/article/10.1088/1748-9326/10/8/084023

Pipeline Futures

• https://medium.com/@AlexSteffen/trump-putin-and-the-pipelines-to-nowhere-742d745ce8fd

World Oil Report

• https://www.greenpolicy360.net/w/File:World_Oil_Report_-_Dec2016.png

International Climate Policy Plans

• https://www.greenpolicy360.net/w/Category:INDC

····················································································

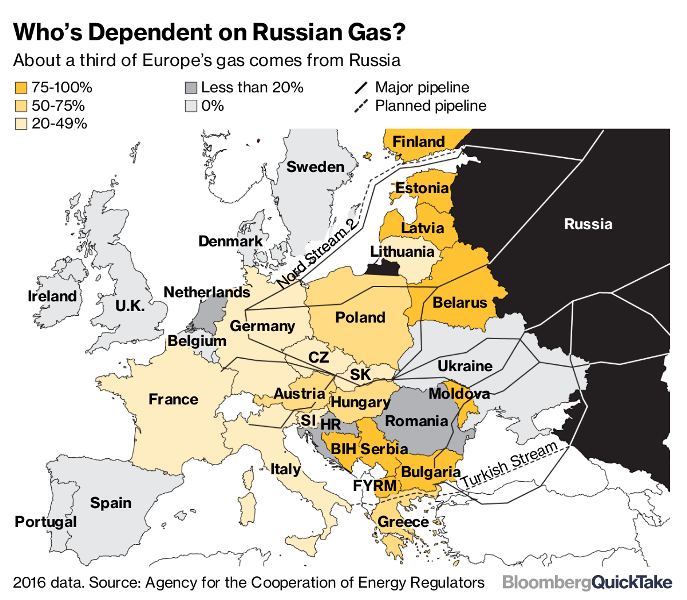

Strategic Demands / Gas/Oil, Global Conflict

- Costs of War

Oil, Power, and War follows the oil industry from its heyday when the first oil wells were drilled to the quest for new sources as old ones dried up. It traces the rise of the Seven Sisters and other oil cartels and exposes oil’s key role in the crises that have shaped our times: two world wars, the Cold War, the Great Depression, Bretton Woods, the 2008 financial crash, oil shocks, wars in the Middle East, the race for Africa’s oil riches, and more. And it defines the oil-born trends shaping our current moment, such as the jockeying for access to Russia’s vast oil resources, the search for extreme substitutes for declining conventional oil, the rise of terrorism, and the changing nature of economic growth.

(The Chelsea 2018 English edition book has been translated from the French title, Or Noir)

The author, Matthieu Auzanneau, is the director of The Shift Project, a European think tank focusing on energy transition and the resources required to make the shift to an economy free from fossil fuel dependence, and also from greenhouse gas emissions. Previously he was a journalist, based in France, and mostly writing for Le Monde. He continues to write his Le Monde blog, Oil Man, which he describes as “a chronicle of the beginning of the end of petroleum.” The original French edition of this book, Or Noir: La grande histoire du pétrole, was awarded the Special Prize of the French Association of Energy Economists in 2016.

"How Fossil Fuel Money Made Climate Change Denial the Word of God"

In 2005, at its annual meeting in Washington, D.C., the National Association of Evangelicals was on the verge of doing something novel: affirming science. Specifically, the 30-million-member group, which represents 51 Christian denominations, was debating how to advance a new platform called “For the Health of a Nation.” The position paper—written the year before An Inconvenient Truth kick-started sense of public urgency around climate change—included a call for evangelicals to protect God’s creation, and to embrace the government’s help in doing so. The NAE’s board had already adopted it unanimously before presenting it to the membership for debate.

At the time, many in the evangelical movement were uncomfortable with its close ties to the Republican anti-environmental regulation agenda. That year, a group called the Evangelical Alliance of Scientists and Ethicists protested the GOP-led effort to rewrite the Endangered Species Act, and the NAE’s vice president of governmental affairs Richard Cizik pushed for the organization to endorse John McCain and Joe Lieberman’s cap-and-trade bill. “For the Health of a Nation,” which Cizik also pushed, was an opportunity to draw a bright line between their support of right-wing social positions on abortion and civil rights and a growing sentiment that God’s creation needed protection from industry.

“Evangelicals don’t want themselves identified as the Republican Party at prayer,” the historian and evangelical Mark Knoll said at the time in support of the platform.

He was wrong. The rank-and-file membership rejected the effort. Like the oil and utilities industries, they decided that recognizing climate change was against their political interests....

ExxonMobile: Politics & Power

July 2016 - Attorneys General Exxon investigation faces investigation by US House Science Com't

June 2016 - Exxon Is Fighting for its Right to Deny Climate Change

- >U.S. Sen. Sheldon Whitehouse, Rhode Island Democrat, leading voice on climate change, locked in bitter brawl with Wall Street Journal editorial page over his proposal to sue fossil fuel companies for fraud

FBI Probe, More AGs Support Investigation of ExxonMobil

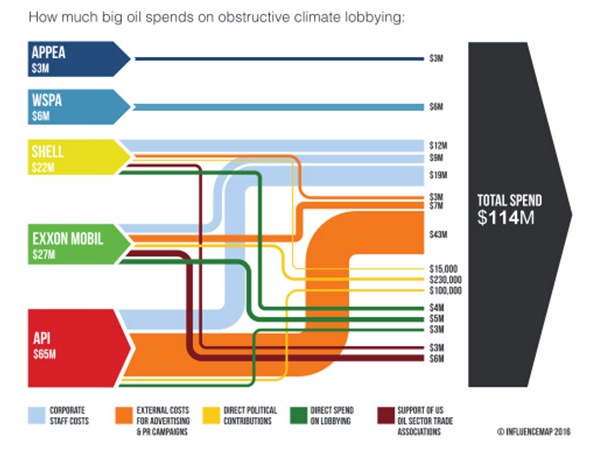

- >Money-in-Politics: Giants of the oil and gas industry spend millions in 2015 to manipulate lawmakers and public discourse on climate change

- Oil Change International ... "Exposing the true costs of fossil fuels"

- While Renewable Energy expands globally with a wide range of investments in energy alternatives to fossil fuels, ExxonMobil predicts "long-term energy demand growth", increased oil/gas profits and "gains in energy efficiency and increased use of renewable energy and lower carbon fuels such as natural gas likely will help lower by half the “carbon intensity of the global economy.”

○

"Private Empire: ExxonMobil and American Power"

NYT: Private Empire -- "A Well-Oiled Machine"

- Paperback: 704 pages

- Publisher: Penguin - May 2013

“ExxonMobil has met its match in Coll, an elegant writer and dogged reporter… extraordinary… monumental.”

- -- Washington Post

“Fascinating… Private Empire is a book meticulously prepared as if for trial, a lawyerly accumulation of information that lets the facts speak for themselves… a compelling and elucidatory work.”

- -- Bloomberg

“Private Empire is meticulous, multi-angled and valuable… Mr. Coll’s prose sweeps the earth like an Imax camera.”

- -- Dwight Garner, NY Times

"ExxonMobil has cut a ruthless path through the Age of Oil. Yet intense secrecy has kept one of the world's largest companies a mystery, until now. Private Empire: ExxonMobil and American Power is a masterful study of Big Oil's biggest player… Coll's in-depth reporting, buttressed by his anecdotal prose, make Private Empire a must-read. Consider Private Empire a sequel of sorts to The Prize, Daniel Yergin's Pulitzer-winning history of the oil industry… Coll's portrait of ExxonMobil is both riveting and appalling… Yet Private Empire is not so much an indictment as a fascinating look into American business and politics. With each chapter as forceful as a New Yorker article, the book abounds in Dickensian characters.”

- -- San Francisco Chronicle

"Coll makes clear in his magisterial account that Exxon is mighty almost beyond imagining, producing more profit than any American company in the history of profit, the ultimate corporation in 'an era of corporate ascendancy.' This history of its last two decades is therefore a revealing history of our time, a chronicle of the intersection between energy and politics."

- -- Bill McKibben, NY Review of Books

"Groundbreaking... Masterful as a corporate portrait, Private Empire gushes with narrative."

- -- American Prospect

···········································

Threat Environment

ExxonMobil Under Investigation

NY's State Attorney and Calif's AG Go After ExxonMobil

FBI Probe, More AGs Support Investigation of ExxonMobil

- Money-in-Politics: Giants of the oil and gas industry spend millions in 2015 to manipulate lawmakers and public discourse on climate change

Oil Change International ... "Exposing the true costs of fossil fuels"

Markets Are Spooked ... Oil Slide Continues

70 percent drop in oil prices over the last 18 months

Exxon Mobile predicts "long-term demand growth" and profits in investor report...

Today in Energy -- US Energy Information Agency -- https://www.eia.gov/todayinenergy/

○

Subcategories

This category has the following 9 subcategories, out of 9 total.

A

E

N

P

R

Pages in category "Fossil Fuels"

The following 47 pages are in this category, out of 47 total.

C

E

- Each of us can make a positive difference

- Earth and Space, Politics

- Earth Day Summit - April 22 2021

- EarthTime

- Environmental full-cost accounting

- Environmental Studies Online

- ESA Living Planet Announcement - May 2022

- European Union Green Deal - Fit for 55

- EV Corridors Electric Vehicles Zero Emission Vehicles

G

- Glasgow Climate Summit - Pledges, Promises, Declarations - What's Next Up

- Global Climate Action Summit

- Going Green: Texas v. Pennsylvania

- Green Stories of the Day

- GreenPolicy360 Archive Highlights 2013

- GreenPolicy360 Archive Highlights 2014

- GreenPolicy360 Archive Highlights 2015

- GreenPolicy360 Archive Highlights 2016

- GreenPolicy360 Archive Highlights 2017

- GreenPolicy360 Archive Highlights 2018

- GreenPolicy360 Archive Highlights 2019

- GreenPolicy360 Archive Highlights 2020

- GreenPolicy360 Archive Highlights 2023

- GreenPolicy360 Archive Highlights 2024

Media in category "Fossil Fuels"

The following 200 files are in this category, out of 608 total.

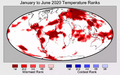

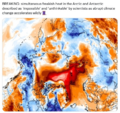

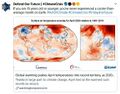

(previous page) (next page)- 2020 record temperatures.png 800 × 502; 358 KB

- 33 false statements.png 640 × 91; 19 KB

- 7-20-2020 GreenPolicy360 RT No.2.jpg 591 × 510; 125 KB

- A Brief History of the Future - 2s.jpg 448 × 309; 70 KB

- A Flash of Green by John D. MacDonald.jpg 400 × 400; 55 KB

- A scorching year, what about the 360 warming data.jpg 600 × 706; 106 KB

- A War on Science.png 800 × 389; 705 KB

- Acceptance on behalf of the United States of America.png 448 × 306; 62 KB

- Act now for a livable future.png 501 × 275; 272 KB

- Ag production and GHG emissions.jpg 680 × 510; 33 KB

- Air Pollution Kills, Injures, Cripples, Disables.jpg 600 × 697; 153 KB

- Alaska Willow - March 12 2023.png 576 × 230; 99 KB

- Alaska Willow News-March 12 2023.png 576 × 625; 235 KB

- Amazon fires burn across the rainforest.jpg 800 × 504; 76 KB

- American Legislative Exchange Council.jpg 646 × 143; 41 KB

- Andrew Wheeler - EPA chief-coal industry lobbyist.jpg 640 × 352; 33 KB

- Andrew Wheeler confirmed to head EPA.jpg 753 × 600; 85 KB

- Antarctica-2018.jpg 768 × 1,024; 82 KB

- AOC re climate task force - july 8 2020.jpg 585 × 203; 38 KB

- Aramco profits soar - 2022.png 636 × 684; 373 KB

- Arctic - Antarctic - Breaking.png 639 × 600; 903 KB

- Arctic - Kolbert - 2023.png 553 × 476; 274 KB

- Arctic 30.1 C at 62.5 N.jpg 800 × 432; 80 KB

- Arctic heat in Russia-Siberia 2020.gif 784 × 408; 3.6 MB

- Arctic is in Crisis.png 800 × 432; 770 KB

- Arctic mdl 1990-2010.jpg 720 × 667; 149 KB

- Arctic Melt - 1950-2020.png 640 × 349; 287 KB

- Arctic Sea Ice News.png 800 × 439; 458 KB

- Arctic Siberia Heatwave - Again - June 2021.jpg 640 × 360; 83 KB

- Arctic-asia mdl 1990-2010.jpg 720 × 667; 158 KB

- Arctic-March30,2019.jpg 797 × 600; 126 KB

- Arctic-Siberia-6-20-2020.jpg 478 × 644; 148 KB

- Atmosphere Science.jpg 800 × 600; 45 KB

- Atmospheric Experiment of Humanity.jpg 519 × 574; 201 KB

- AU Too Hot.png 640 × 413; 286 KB

- Austin Texas is connected to the Arctic - February 2021.jpg 559 × 619; 163 KB

- Banking - finance - climate - Mann-1.jpg 452 × 640; 162 KB

- Banking - finance - climate - Mann-2.jpg 452 × 640; 164 KB

- Battle for Democracy.jpg 640 × 123; 24 KB

- Bernie Sanders, Senate 2.PNG 800 × 517; 379 KB

- Bernie Sanders, Senate Aug 3.PNG 800 × 518; 388 KB

- Biden - clean energy ambitions.JPG 640 × 334; 31 KB

- Biden announces EV policies - Aug 2021.jpg 600 × 604; 112 KB

- Biden introduces leadership team - Nov 24 2020.jpg 800 × 644; 173 KB

- Biden selects Kerry as special climate envoy.jpg 592 × 505; 87 KB

- Biden urged to act - Oct 18 2021 - The Guardian.png 663 × 600; 497 KB

- Biden's assembled an all-star climate team 4-21-2021.jpg 682 × 732; 309 KB

- Biden-January 27 2021-Environment Day 1-News headlines.jpg 800 × 673; 122 KB

- Biden-January 27 2021-Environment Day 1.jpg 800 × 500; 80 KB

- Biden-Sanders Unity Task Force on Climate.jpg 701 × 780; 139 KB

- Big oil lobbying spend.jpg 600 × 450; 64 KB

- Big Oil Rocked by News May 27 2021.jpg 639 × 600; 84 KB

- Big Wobble 2020.jpg 507 × 342; 79 KB

- Bill Nelson on Global Temp Rise and Climate Change.png 640 × 353; 100 KB

- Bill Nye The Planet's on Fire.jpg 800 × 675; 106 KB

- BlackRock CEO says the climate crisis is about to trigger.jpg 594 × 510; 105 KB

- BlackRock on financial security and climate.jpg 508 × 789; 147 KB

- Bloomberg Carbon Clock 10-26-2021 8-47-05 AM EST.png 800 × 195; 356 KB

- Bloomberg Live Climate Data Dashboard.jpg 640 × 756; 156 KB

- BP profit 14 yr high - Aug 2022.png 640 × 212; 63 KB

- Breakpoint - Reckoning with America's Environmental Crisis.jpg 329 × 500; 49 KB

- Bridenstine talks.png 1,485 × 911; 223 KB

- Buckminster and a Geodesic Dome.jpg 600 × 600; 79 KB

- Burst of climate denial as Trump presidency ends.jpg 632 × 604; 92 KB

- Car heating and cooling.png 465 × 635; 261 KB

- Carbon Brief - Greenhouse gas levels 2021.png 640 × 436; 292 KB

- Caribbean Sea hot - June night 2024.png 676 × 600; 386 KB

- Carl Sagan, 1985.PNG 480 × 566; 331 KB

- CCS issues via Guardian opinion - July 2022.png 648 × 326; 83 KB

- CFSV2 world temp July 3, 2023.png 600 × 800; 513 KB

- CH4 graph - 1980-2020.JPG 640 × 446; 22 KB

- Changes in carbon dioxide per 1000 years - via Climate Central.jpg 682 × 424; 34 KB

- China Record Heat - August 2022.png 800 × 1,343; 812 KB

- Christina Korp Earth Day and Apollo 8.jpg 519 × 264; 80 KB

- Citizens Climate Lobby - Save Our Future Act 2021.jpg 518 × 262; 77 KB

- Citizens Climate Lobby - Tampa Bay.jpg 586 × 515; 125 KB

- Climate Action 25th conf in Madrid.jpg 680 × 510; 22 KB

- Climate activist - Steven Schmidt - 1978 on.png 600 × 480; 174 KB

- Climate and National Security.jpg 603 × 533; 157 KB

- Climate Books - 2020.jpg 800 × 450; 69 KB

- Climate cases on the rise - Nature, Sept 2021.png 800 × 562; 181 KB

- Climate Change COP27 - Nov 11 2022 US Representatives.jpg 712 × 444; 54 KB

- Climate Change COP27 - Nov 11 Kathy Castor.jpg 712 × 710; 77 KB

- Climate Change debate-by demanding balance.png 550 × 437; 245 KB

- Climate Change from Space - Climate Kit via ESA - 2022.png 800 × 421; 651 KB

- Climate Change Laws - database collaboration.png 640 × 271; 76 KB

- Climate Change Laws of the World - database.PNG 768 × 845; 383 KB

- Climate Change Litigation Databases Climate Law.png 800 × 330; 73 KB

- Climate Change Poses a Widening Threat to National Security.png 600 × 781; 310 KB

- Climate Change US EPA.jpg 600 × 703; 95 KB

- Climate Conferences 1979-2020.jpg 768 × 768; 121 KB

- Climate Crisis - Emily Atkin Heated No. 1.jpg 537 × 453; 61 KB

- Climate Crisis and the Global Green New Deal.jpg 293 × 418; 33 KB

- Climate debate.jpg 493 × 580; 129 KB

- Climate Desk.jpg 390 × 226; 21 KB

- Climate diplomacy is failing - June 2020.jpg 592 × 440; 71 KB

- Climate Emergency Institute - Oct 2022.png 610 × 600; 274 KB

- Climate Emergency Institute -- 2021.jpg 800 × 450; 55 KB

- Climate emergency.jpg 800 × 450; 69 KB

- Climate Headline News around the World - July 2023.jpg 600 × 704; 151 KB

- Climate Lawsuit-Our Childrens Trust-Florida.png 462 × 760; 289 KB

- Climate Legacy of Biden.jpg 600 × 687; 265 KB

- Climate Models.png 639 × 558; 123 KB

- Climate News - Oct 28 2022.jpg 626 × 600; 88 KB

- Climate News - United Nations Report - Feb 2022.png 768 × 878; 539 KB

- Climate News Dec 4 2023 in Dubai.png 800 × 1,037; 649 KB

- Climate Plans Enforcement - Resources - GreenPolicy.png 768 × 897; 686 KB

- Climate poll - Florida.png 640 × 267; 36 KB

- Climate skeptics, science doubters.png 492 × 481; 152 KB

- Climate strike - Week 171.png 739 × 600; 834 KB

- Climate Strike Around the World - Sep20,2019.jpg 700 × 830; 119 KB

- Climate Summit - Leonardo DiCaprio.png 600 × 663; 521 KB

- Climate Summit live updates - Nov 2 2021.png 751 × 600; 420 KB

- Climate Summit planned-1.jpg 800 × 301; 53 KB

- Climate Summit planned-2.jpg 800 × 187; 31 KB

- Climate Summit planned-3.jpg 800 × 278; 44 KB

- Climate Summit planned-4.jpg 800 × 241; 41 KB

- Climate usa 60 years on.jpg 800 × 480; 34 KB

- ClimateNews 360.jpg 172 × 172; 9 KB

- ClimateNewsFlorida.jpg 448 × 191; 36 KB

- CO2 at Mauna Loa data - June 02, 2020 - 417.90 ppm.jpg 640 × 566; 66 KB

- CO2 cumulative emissions 1850 - 2021 - countries.jpg 640 × 462; 211 KB

- CO2 Emissions per Capita by Country 1960-2014.png 800 × 451; 424 KB

- CO2 emissions-around-the-world.png 800 × 595; 123 KB

- CO2 global pathways via IPCC AR6 - how will we respond.jpg 800 × 450; 57 KB

- CO2 since 1751.png 640 × 400; 40 KB

- COP26 Climate Summit concludes.jpg 600 × 800; 160 KB

- COP26 concludes - 2.png 648 × 467; 177 KB

- COP26 concludes - 3.png 648 × 713; 416 KB

- COP26 concludes.png 648 × 528; 329 KB

- COP26 in GLASGOW - 31 OCT-12 NOV 2021.jpg 800 × 264; 51 KB

- COP27 'opening speech'.png 640 × 460; 160 KB

- COP28 News - Dec 13 2023.png 800 × 898; 410 KB

- Coral bleaching - August 2023.png 488 × 430; 261 KB

- Coral bleaching - NOAA - August 2023.png 488 × 338; 201 KB

- Costs of War US Post 9-11 War Spending.jpg 800 × 305; 60 KB

- Covering Climate Now.jpg 493 × 498; 67 KB

- Cradle of Civilization - and climate change.jpg 640 × 360; 70 KB

- Cumulative CO2 Emissions by Country Since 1850.png 800 × 445; 445 KB

- Dark Money Book FOC.jpg 408 × 630; 73 KB

- Dated record of Earths climate - Science Report Sept 10 2020.jpg 735 × 669; 192 KB

- Death Valley ... the heat, what its like.jpg 640 × 381; 62 KB

- Deepwater-Horizon.jpg 800 × 480; 53 KB

- Defend Our Future 6-1-2020.jpg 585 × 458; 103 KB

- Democratic Climate Plan-Introduced June 2020.jpg 528 × 561; 117 KB

- Democratic National Convention-62 climate speakers.jpg 443 × 407; 57 KB

- Democratic Party Climate Bill - Aug 2022.png 640 × 269; 70 KB

- Democratic Party pres candidates debate in Miami-June 2019.jpg 800 × 534; 124 KB

- Democratic presidential candidates on the Green New Deal.jpg 800 × 359; 57 KB

- Denying human-caused climate change.jpg 639 × 620; 129 KB

- DeSantis against climate science - 2.jpg 640 × 480; 122 KB

- DeSantis against climate science - again.jpg 460 × 640; 105 KB

- Diesel-smoke-externalities.jpg 220 × 276; 16 KB

- Don't Look Up ....jpg 430 × 543; 172 KB

- Don't Look Up.jpg 800 × 450; 104 KB

- Donald Trump-Jair Bolsonaro-March 2019.jpg 640 × 455; 57 KB

- Drilled - Website.jpg 800 × 643; 67 KB

- Earth and Space, Politics.png 796 × 765; 349 KB

- Earth atmosphere ISS October30,2014.jpg 590 × 392; 12 KB

- Earth Day 2021 - Climate Summit News-1.jpg 491 × 270; 127 KB

- Earth Day 50 years on.jpg 480 × 548; 107 KB

- Earth Day and Climate at the Center.jpg 595 × 604; 131 KB

- Earth Information Center - NASA 336.png 336 × 336; 279 KB

- Earth Information Center - NASA.png 768 × 769; 1.21 MB

- Earth Summit 1992-s.png 336 × 418; 283 KB

- Earth Summit 1992.jpg 600 × 746; 171 KB

- Earth System Observatory.jpg 457 × 338; 47 KB

- Earth trapping unprecedented amount of heat - NASA.jpg 468 × 373; 56 KB

- Earth-upper-atmosphere-NASA.jpg 800 × 781; 327 KB

- Earths two lungs.png 336 × 336; 130 KB

- EarthScience Missions via the EOS - 2022.png 800 × 219; 139 KB

- Ebell-Trump.png 491 × 453; 135 KB

- Economist.com global capital snapshot as of July 2020.jpg 800 × 477; 119 KB

- EDF satellite - methane tracking.png 600 × 674; 388 KB

- Elon Musk on climate change, Sept. 2024.png 354 × 336; 87 KB

- Elon Musk quote - gas externality price.png 680 × 320; 199 KB

- Emissions graph - gleick tw 2018.jpg 640 × 364; 37 KB

- End of coal power in UK - 1.jpg 800 × 868; 112 KB

- End of coal power in UK - 2.png 800 × 557; 225 KB

- End of coal power in UK - 3.png 800 × 562; 240 KB

- End of Coal Power in UK.png 800 × 925; 739 KB

- Energy - Electric Measuring and Monitoring.png 715 × 1,978; 862 KB

- Energy Charter Treaty.jpg 512 × 480; 74 KB

- Energy dependency-EU-28 as of 2016.png 671 × 597; 123 KB

- Energy Imbalance, Climate Change - Aug 1 2021.png 640 × 672; 394 KB

- Energy stocks performance-S&P 500 - 2018.png 640 × 618; 288 KB

- Env protection on the way out Jan2018 summary.png 418 × 789; 57 KB

- Env protection on the way out Jan2018.png 582 × 522; 48 KB

- Environmental laws in US - Supreme Court votes soon.png 800 × 414; 334 KB

- EPA Lee Zeldin Hearing - 1.png 600 × 693; 304 KB

- EPA Lee Zeldin Hearing.png 637 × 600; 414 KB

- EPA website a 'ghost page' now.png 667 × 233; 45 KB

- ESA Living Planet Symposium - Announcement.png 637 × 600; 508 KB

- Atmospheric Science

- Biosphere

- Citizen Science

- Climate Change

- Climate Policy

- Divestment from Fossil Fuels

- Eco-nomics

- EOS eco Operating System

- Earth Observations

- Earth Science

- Energy

- Environmental Full-cost Accounting

- Environmental Protection

- Environmental Security

- Environmental Security, National Security

- Externalities

- Global Security

- Global Warming

- Natural Resources

- Networking

- New Definitions of National Security

- Ocean Science

- Peace

- Planet Citizen

- Planet Scientist

- Planet Citizens, Planet Scientists

- Renewable Energy

- Sea-Level Rise & Mitigation

- Strategic Demands

- ThinBlueLayer

- Whole Earth