Time for a Price on Carbon

Confronting * Externalities * True Costs * Damage to 'The Commons'

- SJS/GreenPolicy360 Siterunner -- We/GreenPolicy360 recommend a new descriptor for emissions-externalities-carbon pricing -- Not a tax, let's call it...

- +Emissions Cost... +EC

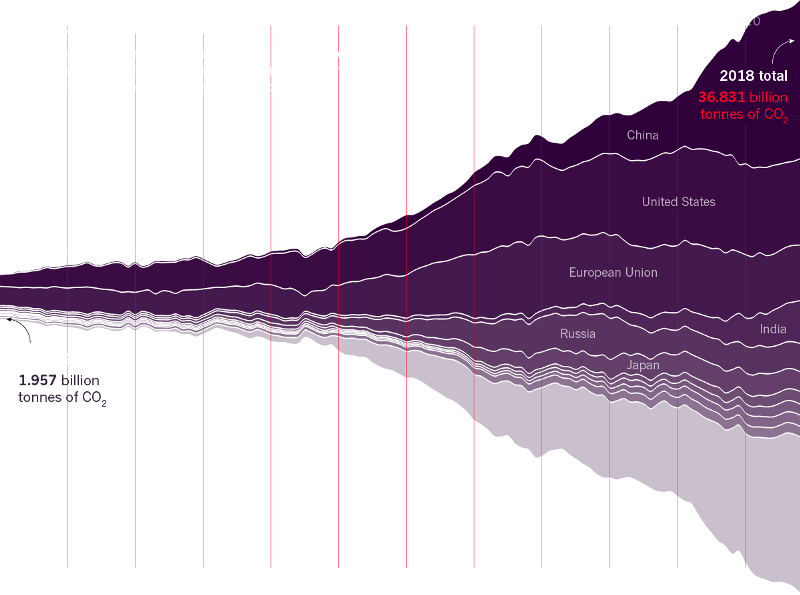

2019

The Green New Deal and the carbon tax

The October 2018 UN annual report on climate change issues the sternest warning yet that climate change caused by human activity is accelerating. This series of reports has triggered two meaningful responses. First, the Green New Deal called for government command-and-control measures that would phase out fossil fuel-based energy over the next 11 years. The other favored new regulatory efforts, such as the carbon tax, would use price incentives to induce market participants to reduce their greenhouse gas emissions...

2018

The challenge of selling the carbon tax

The carbon tax, a price regulation for the control of human-produced CO2 emissions, should have broad appeal, both to those skeptical of government regulation and to those skeptical of market forces. It should even appeal to those skeptical that humans contribute to climate change. But the carbon tax is based on an idea over 100 years old, so why hasn’t it gained sufficient support to be implemented? Part of the answer lies in the commonly held, non-rigorous opposition to tax increases, whether of general taxes or of user fees like carbon taxes, that retards careful discussion of this promising approach to a serious public policy problem.

The atmosphere is a "common access resource." Consequently, an unregulated "free market" cannot require payment when polluters emit CO2 into the atmosphere. This absence of a price encourages excessive discharges of these heat-trapping gases. The implementation of a carbon tax will insert the missing price, reducing the incentive to emit CO2. Profit-seeking firms will direct their engineers and scientists to continually seek emission-reducing methods that are cheaper than paying the tax...

Charge €30 a tonne for CO2 to avoid catastrophic 4C warming

Via The Guardian / New global policies and carbon pricing are needed to avoid an apocalyptic increase in temperature

···············································································

A Proposal from the US Citizens' Climate Lobby

Basics of Carbon Fee and Dividend: How Carbon Fee and Dividend Works

2017

2016

Carbon pricing, an efficient way to cut pollution

Time for a carbon tax / Brookings

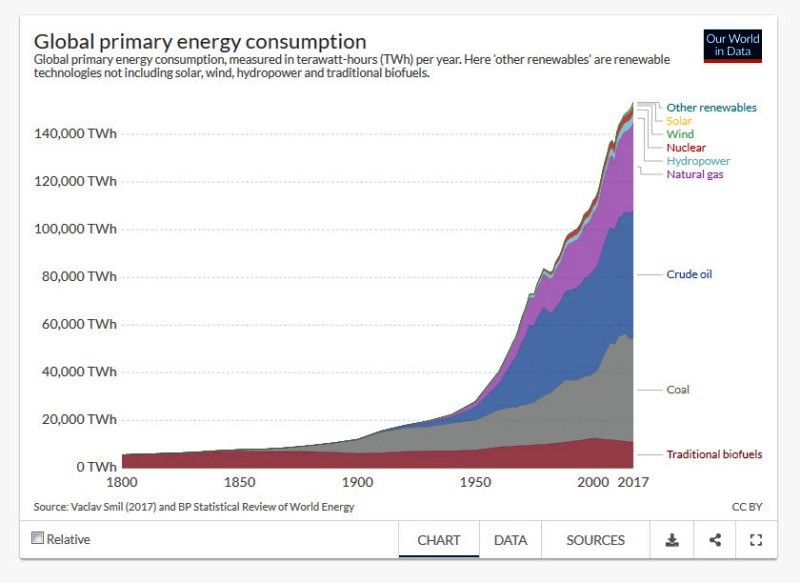

Over the last few decades, oil prices have fluctuated widely – ranging from $10 to $140 a barrel – posing a challenge to producers and consumers alike. For policymakers, however, these fluctuations present an opportunity to advance the key global objectives – reflected in the Sustainable Development Goals adopted last September and the climate agreement reached in Paris in December – of mitigating climate change and building a more sustainable economy...

2015 / 2014

World Bank Climate Change Programs

California Shows How Carbon Pricing Can Reduce Emissions Efficiently & Cost Effectively

Wall Street Journal: Should there be a price on carbon?

- Carbon CO2 costs, CO2 pricing - http://www.theguardian.com/environment/2012/jul/16/carbon-price-tax-cap

- Time for a price on carbon - http://archpaper.com/news/articles.asp?id=7390

- Hank Paulson: Time for Republicans to stand up - http://thinkprogress.org/climate/2014/06/22/3451687/hank-paulson-climate-crash-carbon-tax

- Lessons Learned in the 2008 Recession - http://www.nytimes.com/2014/06/22/opinion/sunday/lessons-for-climate-change-in-the-2008-recession.html

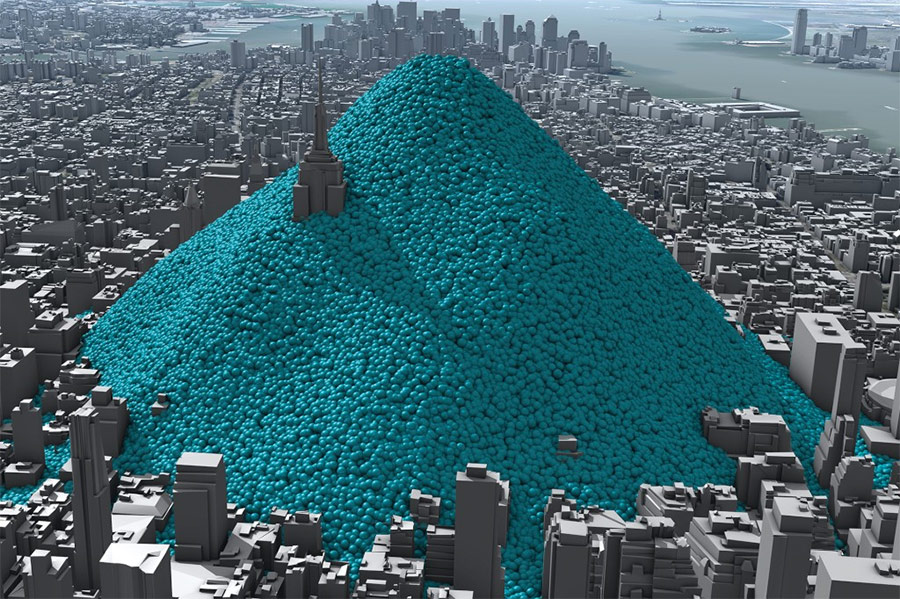

One Day (in the Year 2010) of New York City's Carbon Emissions / Graphic

Regulatory Options

Wikipedia:

Cap and Trade_Emissions Trading

○ ○ ○ ○ ○

Government Policy

June 2014

President Obama re: CO2 emissions:

“[I]f there’s one thing I would like to see, it’d be for us to be able to price the cost of carbon emissions. … We’ve obviously seen resistance from the Republican side of the aisle on that. And out of fairness, there’s some Democrats who’ve been concerned about it as well, because regionally they’re very reliant on heavy industry and old-power plants. … I still believe, though, that the more we can show the price of inaction — that billions and potentially trillions of dollars are going to be lost because we do not do something about it — ultimately leads us to be able to say, ‘Let’s go ahead and help the marketplace discourage this kind of activity.’”

○ ○ ○ ○ ○

Corporate Policy

Corporate planning for carbon tax/costing

International Emissions Trading Association

Externalities

Full-Cost/True-Cost Accounting

Social Costs/External Costs

Social costs of carbon (EPA est)

-=-=-=-=-=-=-=-=-=-=--=-=-=-=-=-=-=-=-

Natural Capital & Externalities

-- http://en.wikipedia.org/wiki/Externality

Grist -- grist for thought... (2013) -- The notion of “externalities” has become familiar in environmental circles. It refers to costs imposed by businesses that are not paid for by those businesses. For instance, industrial processes can put pollutants in the air that increase public health costs, but the public, not the polluting businesses, picks up the tab. In this way, businesses privatize profits and publicize costs.

If we take the idea seriously, not just as an accounting phenomenon but as a deep description of current human practices, its implications are positively revolutionary.

[Begin by reviewing] a Natural Capital & Externalities Report conducted by environmental consultancy Trucost on behalf of The Economics of Ecosystems and Biodiversity (TEEB) program sponsored by United Nations Environmental Program. TEEB asked Trucost to tally up the total “unpriced natural capital” consumed by the world’s top industrial sectors. (“Natural capital” refers to ecological materials and services like, say, clean water or a stable atmosphere; “unpriced” means that businesses don’t pay to consume them.)

It’s a huge task; obviously, doing it required a specific methodology that built in a series of assumptions. (Plenty of details in the report.) But it serves as an important signpost pointing the way to the truth about externalities.

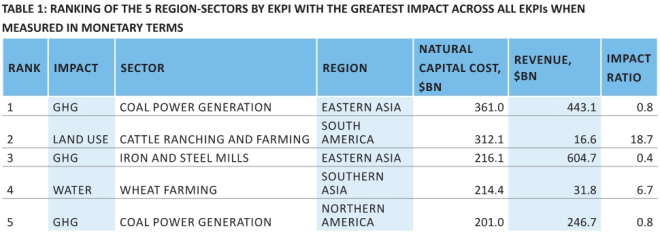

Here’s how those costs break down:

The majority of unpriced natural capital costs are from greenhouse gas emissions (38%), followed by water use (25%), land use (24%), air pollution (7%), land and water pollution (5%), and waste (1%).

So how much is that costing us? Trucost’s headline results are fairly stunning.

First, the total unpriced natural capital consumed by the more than 1,000 “global primary production and primary processing region-sectors” amounts to $7.3 trillion a year — 13 percent of 2009 global GDP.

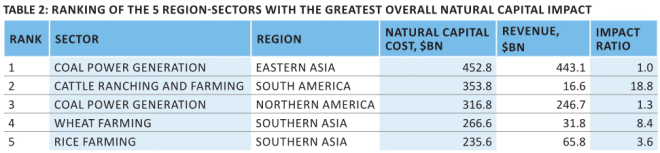

Second... Surprising no one, coal is the enemy of the human race. Trucost compiled rankings, both of the top environmental impacts and of the top industrial culprits.

The biggest single environmental cost? Greenhouse gases from coal burning in China. The fifth biggest? Greenhouse gases from coal burning in North America.

Trucost’s third big finding is the coup de grace. Of the top 20 region-sectors ranked by environmental impacts, none would be profitable if environmental costs were fully integrated. Ponder that for a moment: None of the world’s top industrial sectors would be profitable if they were paying their full freight. Zero.

Coal power generation in Eastern Asia, which generates revenues of $443.1bn, has a natural capital cost of $452.8bn (that's unpriced natural capital – the report already takes into account the various ways in which industries are forced to price in their externalities), largely due to greenhouse gases. Cattle ranching in South America, with revenues of $16.6bn, has capital cost of $353.8bn, due to the unpriced cost of land use. And so on.

You can quibble the figures – and doubtless many will – but what is clear is they are large. Really, really large. Many of the biggest industries in the world can only exist because they don't have to pay the true environmental cost of what they do. The word "unsustainable" is thrown around too much these days, but it seems to fit here.

The Top 100 Externalities of Business

○

- Climate Change

- Climate Policy

- Earth Observations

- Earth Science

- Ecology Studies

- Environmental Full-cost Accounting

- Environmental Security

- Environmental Security, National Security

- EOS eco Operating System

- Externalities

- Fossil Fuels

- Global Security

- Global Warming

- New Definitions of National Security

- Planet Citizens

- Planet Citizens, Planet Scientists

- Planet Scientist

- Sea-Level Rise & Mitigation

- Strategic Demands

- Sustainability

- Sustainability Policies

- ThinBlueLayer