Time for a Price on Carbon

It's Time

2016

Carbon pricing is an efficient way to cut pollution

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○

Time for a price on carbon dioxide emissions

Full-cost, green accounting / true pricing

The cost of CO2 needs to be taken into account

2015/2014

Citizen Climate Lobby - http://citizensclimatelobby.org/carbon-fee-and-dividend/

World Bank - http://www.worldbank.org/en/programs/pricing-carbon

World Bank "Turn Down the Heat" - http://www.worldbank.org/en/topic/climatechange/publication/turn-down-the-heat

World Bank Climate Change Programs

Energy CEO: California Shows How Carbon Pricing Can Reduce Emissions Efficiently & Cost Effectively

Carbon Pricing Leaders - Model Programs/Best Practices

- Should there be a price on carbon - Wall Street Journal [1]

- What is a carbon price and why do we need one? - Guardian [2]

- Time for a price on carbon [3]

- Repubs sign up, Hank Paulson [4]

- Lessons Learned - New York Times - [5]

_ _ _ _

Regulatory Options

Wikipedia Carbon Tax -- Carbon Price -- Cap and Trade_Emissions Trading

_ _ _ _

Government Policy

June 2014

President Obama re: CO2 emissions:

“[I]f there’s one thing I would like to see, it’d be for us to be able to price the cost of carbon emissions. … We’ve obviously seen resistance from the Republican side of the aisle on that. And out of fairness, there’s some Democrats who’ve been concerned about it as well, because regionally they’re very reliant on heavy industry and old-power plants. … I still believe, though, that the more we can show the price of inaction — that billions and potentially trillions of dollars are going to be lost because we do not do something about it — ultimately leads us to be able to say, ‘Let’s go ahead and help the marketplace discourage this kind of activity.’”

_ _ _ _

Corporate Policy

Corporate planning for carbon tax/costing [6] [7]

International Emissions Trading Association

Externalities

Full-Cost/True-Cost Accounting

Social Costs/External Costs

Social costs of carbon (EPA est)

-=-=-=-=-=-=-=-=-=-=--=-=-=-=-=-=-=-=-

Natural Capital & Externalities

-- http://en.wikipedia.org/wiki/Externality

Grist -- grist for thought... (2013) -- The notion of “externalities” has become familiar in environmental circles. It refers to costs imposed by businesses that are not paid for by those businesses. For instance, industrial processes can put pollutants in the air that increase public health costs, but the public, not the polluting businesses, picks up the tab. In this way, businesses privatize profits and publicize costs.

If we take the idea seriously, not just as an accounting phenomenon but as a deep description of current human practices, its implications are positively revolutionary.

[Begin by reviewing] a Natural Capital & Externalities Report conducted by environmental consultancy Trucost on behalf of The Economics of Ecosystems and Biodiversity (TEEB) program sponsored by United Nations Environmental Program. TEEB asked Trucost to tally up the total “unpriced natural capital” consumed by the world’s top industrial sectors. (“Natural capital” refers to ecological materials and services like, say, clean water or a stable atmosphere; “unpriced” means that businesses don’t pay to consume them.)

It’s a huge task; obviously, doing it required a specific methodology that built in a series of assumptions. (Plenty of details in the report.) But it serves as an important signpost pointing the way to the truth about externalities.

Here’s how those costs break down:

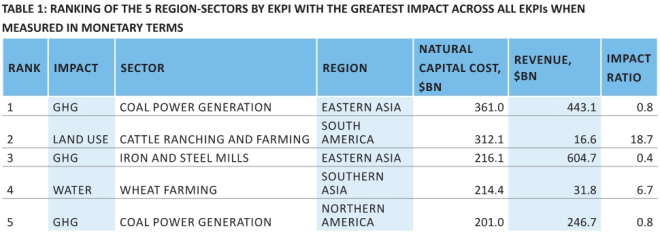

The majority of unpriced natural capital costs are from greenhouse gas emissions (38%), followed by water use (25%), land use (24%), air pollution (7%), land and water pollution (5%), and waste (1%).

So how much is that costing us? Trucost’s headline results are fairly stunning.

§

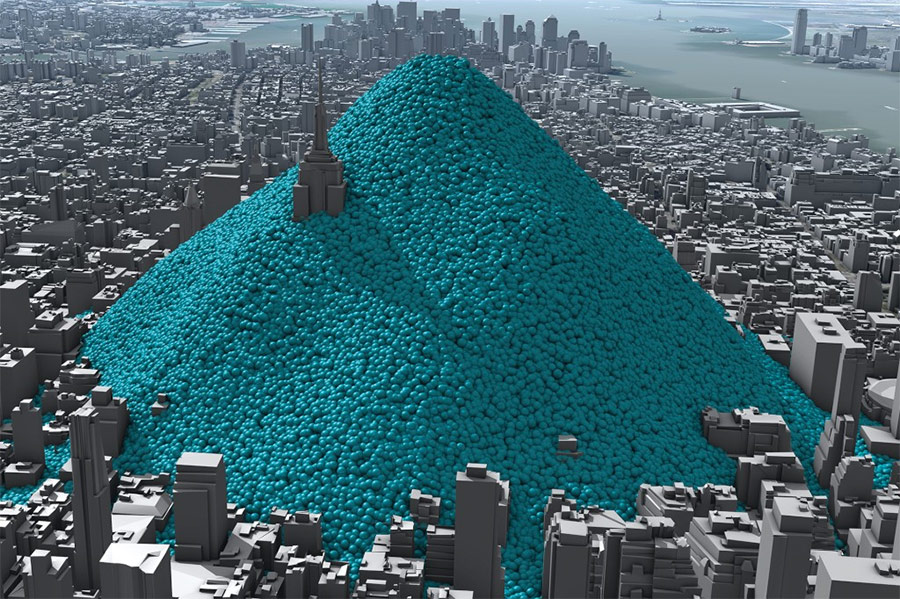

First, the total unpriced natural capital consumed by the more than 1,000 “global primary production and primary processing region-sectors” amounts to $7.3 trillion a year — 13 percent of 2009 global GDP.

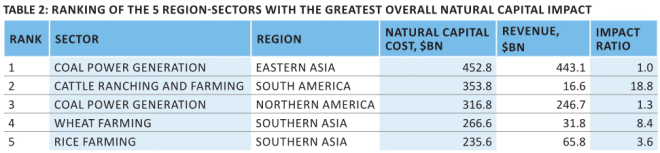

Second... Surprising no one, coal is the enemy of the human race. Trucost compiled rankings, both of the top environmental impacts and of the top industrial culprits.

The biggest single environmental cost? Greenhouse gases from coal burning in China. The fifth biggest? Greenhouse gases from coal burning in North America.

Trucost’s third big finding is the coup de grace. Of the top 20 region-sectors ranked by environmental impacts, none would be profitable if environmental costs were fully integrated. Ponder that for a moment: None of the world’s top industrial sectors would be profitable if they were paying their full freight. Zero.

Coal power generation in Eastern Asia, which generates revenues of $443.1bn, has a natural capital cost of $452.8bn (that's unpriced natural capital – the report already takes into account the various ways in which industries are forced to price in their externalities), largely due to greenhouse gases. Cattle ranching in South America, with revenues of $16.6bn, has capital cost of $353.8bn, due to the unpriced cost of land use. And so on.

You can quibble the figures – and doubtless many will – but what is clear is they are large. Really, really large. Many of the biggest industries in the world can only exist because they don't have to pay the true environmental cost of what they do. The word "unsustainable" is thrown around too much these days, but it seems to fit here.

Natural Capital at Risk: The Top 100 Externalities of Business

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○